5-Step Budgeting Playbook

& how it can break spending guilt for high earners

Think back to your last big splurge. Were you 100% happy with the purchase? Or was there a small, but annoying sense of guilt that you shouldn’t have spent so much money?

Spending guilt is where you buy something you really want and love, but it’s not bringing you 100% joy because you feel like you shouldn’t have spent so much money. It happens to everyone, but I find that many high income earners are unnecessarily susceptible to it because they can actually afford the purchase. The best way to break away from spending guilt is to understand your finances through budgeting.

Budgeting provides clarity to where your money is going by giving you insights to your earnings, savings, and spending. If you understand that you are saving enough to meet your most important financial goals, the rest can be used for whatever you want with confidence, not guilt.

Budgeting is a skill, and like any other skill, it will feel like a heavy lift early on. Technology makes budgeting much easier today, but before you start exploring budgeting apps, I recommend following my 5-Steps to Budgeting Playbook. I personally find starting with a spreadsheet or good old notebook helpful because writing (or typing) something down on paper (spreadsheet) helps me get organized better.

My 5-Step Budgeting Playbook and how I use it:

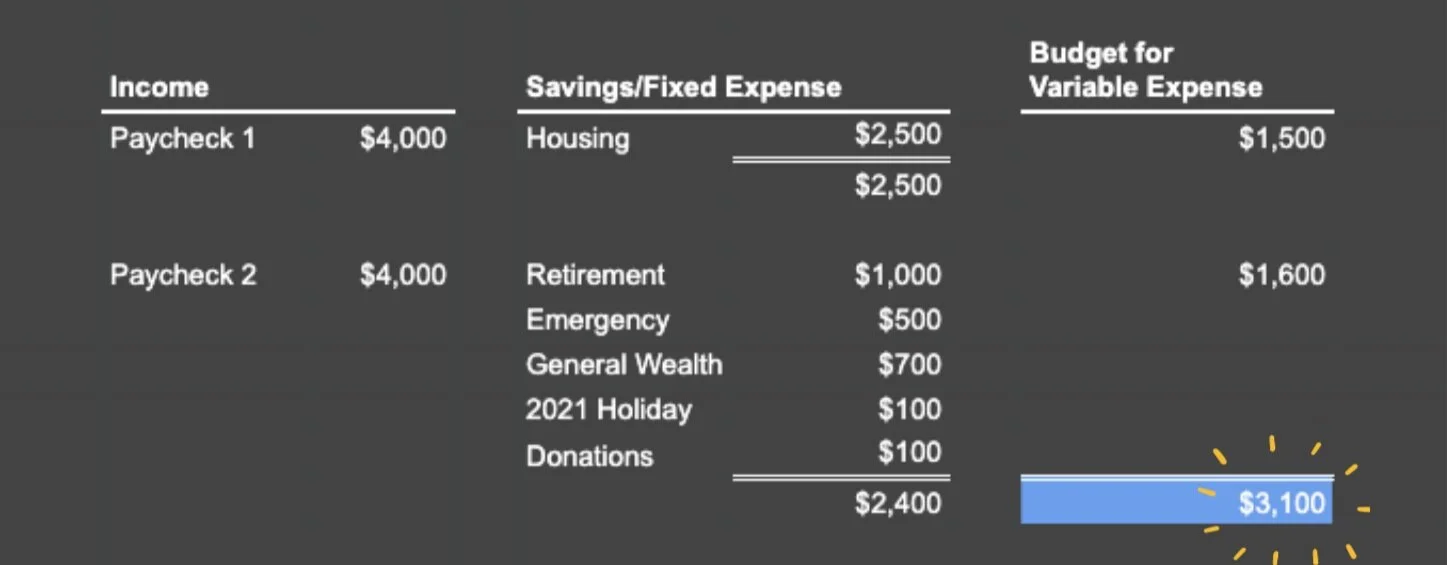

Step 1: Income - I get a relatively consistent paycheck every 2 weeks on the 1st and 15th of each month. If your income varies month to month, put down a conservative average. I have two lines so far (the amounts are not my real budget):

Paycheck 1: $4,000

Paycheck 2: $4,000

Step 2: Savings - I have several financial goals that need to be funded. A few examples include:

Retirement - 401(k) contributions are automatically deducted from payroll, so I just need to worry about contributions to my backdoor Roth IRA and additional savings to a taxable account.

Emergency savings - I decided to increase my emergency savings in 2020.

General wealth building - this is long-term savings that I don’t necessarily have a specific goal for but feel is important to build.

2021 holiday gift budget - holidays are crazy times, and without a specific budget, I easily go overboard with gifts (including gifts to myself). I keep a special savings goal which helps me keep to a specific budget when the crazy time rolls around.

Step 3: Fixed Expenses - these are expenses that occur regularly in equal amounts - such as rent/mortgage and loan payments. I live in San Francisco where rent is obnoxiously expensive. Fortunately, I paid off my student and car loans a few years ago and rent is my only fixed expense.

Step 4: Variable Expenses - these expenses that occur regularly but change from month to month. Another way to differentiate fixed from variable expense is that you can control variable expenses and they can be changed more easily. To keep things simple, I break them into four categories:

Food (groceries & restaurants)

Travel

Quality of life (entertainment, shopping, subscriptions like netflix, spotify - basically everything else that makes life fun and convenient)

Donations (charitable giving)

I keep food and travel as a separate category because it is usually a big expense for me. I lump everything else into just one category called “quality of life”. Donations are a separate category as a self-reminder to give back, plus charitable giving can provide tax benefits so it’s helpful to keep track for when tax season comes around.

Variable expenses are typically things that make life fun and convenient. In order to eliminate spending guilt, use your last last remaining dollars to cover variable expenses. In other words, take income, subtract savings, subtract fixed expenses, and whatever is left is what you can use for whatever you want.

Putting steps 1 - 4 together, my budget looks something like this and shows that I can spend $3,100 monthly on fun things. My rent is due in the first week of the month and generally takes up a large portion of that paycheck, so I use my second paycheck to fund many of my savings goals.

Sample budget through step 4: Shows that after total income of $8,000, and savings/fixed expense of $4,900, you have $3,100 of guilt-free spending available.

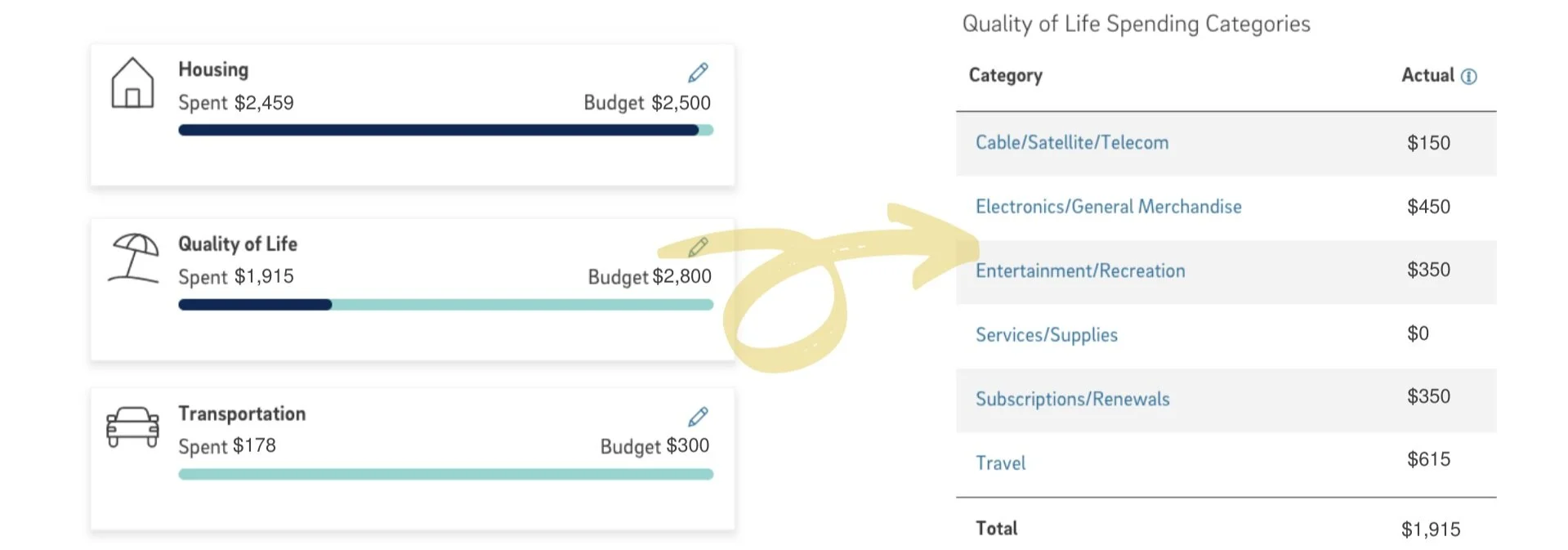

Step 5: Automate - now translate your budget into a budgeting app. I personally use BrightPlan (I am affiliated with BrightPlan) that automatically tracks my income, savings, and spending by linking to my accounts.

There is a monthly fee for BrightPlan, but there are free options such Mint, claritymoney, and Personal Capital (I am not affiliated with these companies). If you care about privacy and don't want your information sold, there are paid options in addition to BrightPlan such as YNAB (You Need A Budget) and simplifi by Quicken (also not affiliated). Use a program that works best for you.

Advanced notice: none of these automation budgeting apps will fit your budget perfectly. Even the BrightPlan app, that I helped to build, doesn’t fit all my categories perfectly. For example, it has a separate category for transportation and lumps travel with Quality of Life. That’s totally ok - don’t get bogged down by these little details. Keep it simple and always go back to the main purpose of budgeting which is to understand your income, expense, and savings.

Sample BrightPlan Budget: Transportation is a separate bucket, and Travel is lumped in with Quality of Life. While many categories are lumped in within a budgeting bucket, the Spending Analysis tool in BrightPlan tracks all the categories in the background in case you want to take a deeper look at your spending.

There is no point of budgeting if you never look at it again. Take an hour or two every month to look at your progress. This hour can help adjust your spending, find more money to save, or simply provide more clarity to what is going on with your money. To make the reviews fun, celebrate the review with:

A nice meal afterwards

A fun hike before or after

Go to your favorite coffee shop to review (post COVID in a safe environment)

Most people don’t know how much they spend each month - with a budget, you’re doing better than 90% of people. Create a budget and shop happy.

If you are interested in testing the BrightPlan app, follow me on Instagram and shoot me a message and I will provide a free trial code.

If you are a busy professional and high earner, and would like to learn more about how you can work with me through Plancorp, schedule a 15-minute call with me below.